Loan officers are charged with creating false gift letters to obscure the source of the borrowers’ down payments and disguise borrowers’ liabilities as assets.

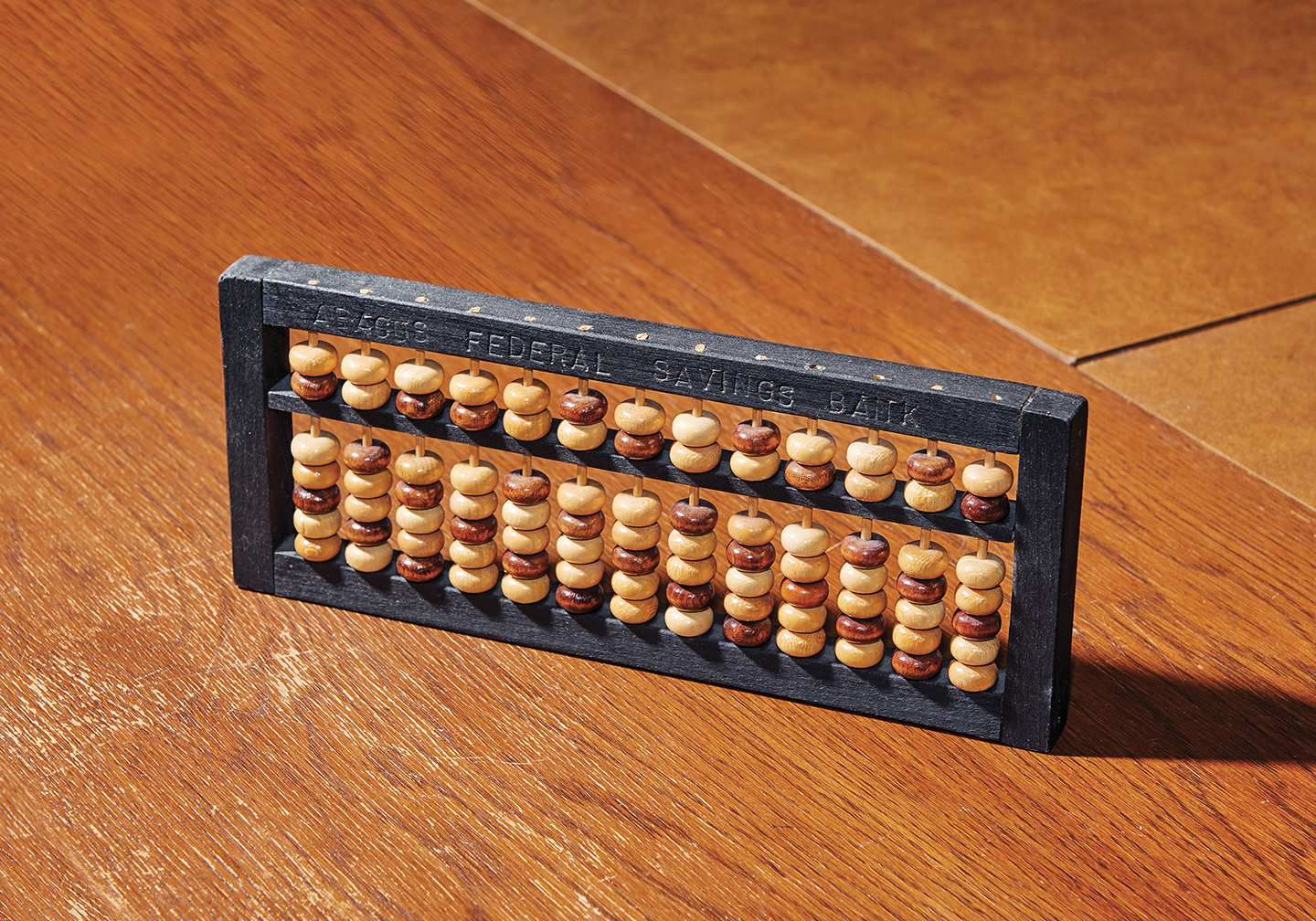

#Abacus bank stream verification#

According to the indictment, originators coached borrowers to inflate their income, assets, and job titles, and to falsify Verification of Employment forms. Managers also encouraged loan officers and processors to be discreet by making sure that the falsified information would be believable in the eyes of the Bank’s regulator, the Office of the Comptroller of the Currency, as well as Fannie Mae.ĪBACUS loan originators, also called loan officers, are accused of regularly instructing prospective borrowers to make misrepresentations in their loan applications and often authored falsified documents themselves. According to the indictment, these ABACUS managers trained lower level employees that the accuracy of loan application information was immaterial what mattered was making sure that borrowers were able to obtain Fannie Mae-backed mortgages. Also charged in the indictment is WAI HUNG “RAYMOND” TAM, the Loan Origination Supervisor. WONG was the most senior Loan Department manager and reported directly to the Bank’s CEO. Fannie Mae then repackaged the fraudulent mortgages into mortgage-backed securities that were sold.Ĭharged in the indictment is YIU WAH WONG, who served as the Bank’s Chief Credit Officer, Vice President, and Underwriting Supervisor. Abacus Bank then sold these loans to Fannie Mae. Law enforcement believes that both managers and employees of Abacus bank regularly and systematically falsified residential mortgage applications.This was done in order to ensure that commissions and fees were earned by getting unqualified borrowers loans. In fact, the New York County District Attorney’s Office believes that those involved were former senior managers and former employees who worked in various capacities for Abacus Bank’s lending business. If prosecutors are correct in their allegations, the defendants involved in this roughly five year long mortgage fraud scam were not low end employees. NY PL 175.10 is an “E” felony with a potential punishment of up to four years in state custody. The “C” felonies of NY PL 155.40 and NY PL 187.20 do not have mandatory terms of incarceration for first time felony offenders, but carry a maximum sentence of five to fifteen years in prison. The most serious of these offenses, NY PL 187.25 and NY PL 155.42, are “B” felonies that require a minimum of one to three and a maximum of eight and one third to twenty five years in prison post conviction. Beyond the eleven individuals arrested in this scheme and the indictment of Abacus Bank, eight other former employees have already pleaded guilty to various felony offenses.Īmong other crimes, the 184 count indictment against Abacus Bank and her eleven former employees charges Residential Mortgage Fraud in the First Degree (New York Penal Law 187.25), Residential Mortgage Fraud in the Second Degree (New York Penal Law 187.20), Grand Larceny in the First Degree (New York Penal Law 155.42, Second Degree Grand Larceny (New York Penal Law 155.40) and Falsifying Business Records in the First Degree (New York Penal Law 175.10). Not merely one or two loans, prosecutors contend these men and women perpetrated a false document mortgage fraud scheme involving sales in the hundreds of millions of dollars. Led by Manhattan District Attorney Cyrus Vance, Jr., prosecutors believe that Abacus Federal Savings Bank and eleven former employees were the central platform behind the sale of fraudulent loans to Fannie Mae.

Nick Fury’s Howling Commandos have struck another blow against alleged criminal disorder in the great City of New York.

0 kommentar(er)

0 kommentar(er)